ev tax credit 2022 texas

The EV tax credit was introduced in the wake of the 2008 financial crisis as part of the American Recovery and Reinvestment Act of. Federal Tax Credit 200000 vehicles per manufacturer.

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

The 2022 Nissan Leaf holds the title of the cheapest MSRP at 28375 and is eligible for a 7500 tax credit.

. 50 of purchase and installation costs up to 500. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The credit amount will vary based on the capacity of the battery used to power the vehicle.

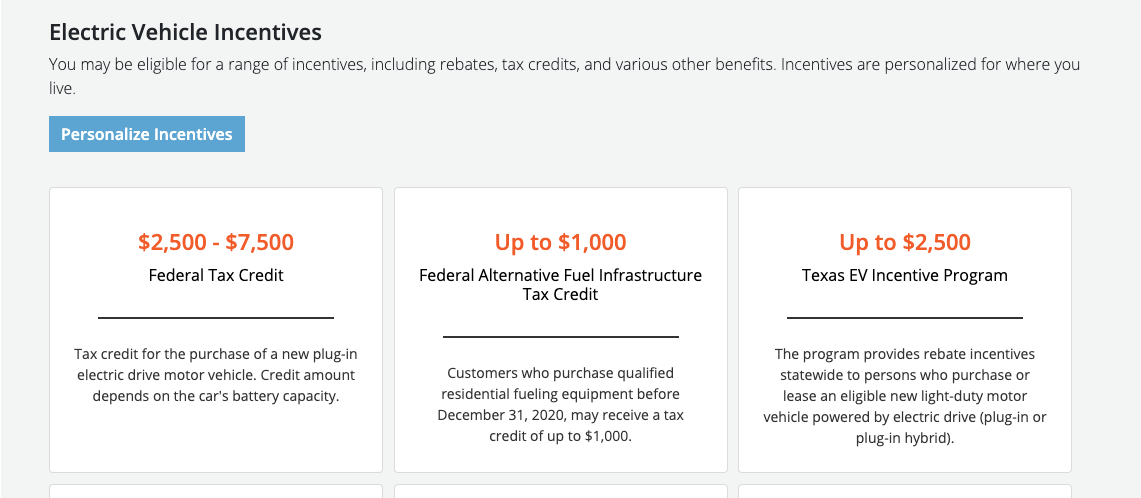

Texas EV Rebate Program 2000 applications accepted per year. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Home Solar Incentives Texas.

Suzanne Harrison D-Draper has offered a bill HB 0221 that would authorize a tax credit for the purchase of an electric vehicle EV a plug-in hybrid or a hydrogen vehicle with a sale price of under 55000. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. This is the largest sum awarded to any state.

On or after January 1 2024. Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed. Here are the currently available eligible vehicles.

Federal Solar Tax Credit ITC Net Metering. Lately lower-end electric vehicles have been hard to find with brisk sales and tight. This incentive covers 30 of the cost with a maximum credit of up to 1000.

The US Federal tax credit is up to 7500 for an buying electric car. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Texas offers numerous incentives and big savings to entice residents to go greenThese include emissions test exemptions for electric cars new and used vehicle rebates for natural gas vehicles plug-in electric vehicle PEV charging station rebates emissions-related repair grants alternative fuel vehicle AFV rebates fuel-efficient auto insurance discounts and more.

Heres a quick look at the solar incentives in Texas. The Only Way the New Model Y from Giga Texas. 60 Million for EV charging in Texas in 2022.

The 2022 Nissan Leaf holds the title of the cheapest MSRP at 28375 and is eligible for a 7500 tax credit. Department of Transportation announced Thursday that Texas is eligible to receive 60356706 for electric vehicle EV charging infrastructure in fiscal year 2022 with 407774759 available over the lifetime of Infrastructure law funding. The size of the tax credit depends on the.

The federal Internal Revenue Service IRS tax credit is for 2500 to 7500 per new EV purchased for use in the US. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. January 1 2023 to December 31 2023.

The State of Texas offers a 2500 rebate for buying an electric car. AUSTIN Texas -- The US. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

Updated March 2022. Lately lower-end electric vehicles have been hard to find with brisk sales and tight. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an.

The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Dual-Motor AWD 6 to 10 months 2022 Model S Plaid 4 to 8 weeks Model 3 RWD 5 to 9 months 2022.

Four Texas electric companies also offer the following incentives to residential customers who install qualifying Level 2 chargers. Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners. 250 rebate and a tax credit for 30 of installation costs.

Southwestern Electric Power Company. By Karsten Neumeister Solar Expert. Several months later it seems that revisions to the credit are returning to lawmaker agendas.

Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. Additional City Utility Rebates. Tesla No Longer Needs the EV Tax Credit.

January 1 2020 to December 31 2022. Under the proposed scheme buyers of new qualified vehicles would get a 3000 tax credit USSA News Utah state Rep.

Us Infrastructure Investment And Jobs Act Of 2021 Assessing The Potential Impact On Electric Vehicles And Electric Vehicle Infrastructure Mayer Brown Tax Equity Times Jdsupra

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Tips For Electric Vehicle Drivers In Texas

Texas Solar Incentives Tax Credits Rebates Sunrun

Tips For Electric Vehicle Drivers In Texas

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Latest On Tesla Ev Tax Credit March 2022

Incentives Austin Energy Ev Buyers Guide

Nissan Ariya And Leaf Will Coexist Two Evs Well Under 40 000 Thanks To Ev Tax Credit

Latest On Tesla Ev Tax Credit March 2022

Texans May Have To Pay 200 Fee For Driving An Electric Vehicle

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Tips For Electric Vehicle Drivers In Texas

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicles Are Hitting The Road After Blackouts And Power Outages Can Texas Support Them